Compound Wealth Blog

Our bank of knowledge

KiwiSaver for Grown Ups - as featured on Interest.co.nz

Why bespoke solutions like KiwiWRAP are reshaping the way serious investors think about retirement savings

A Guide to Managing Bull and Bear Market Cycles

Understand bull and bear market cycles, how long they last, and why staying invested matters for long-term investors. Data as at 28 December 2025.

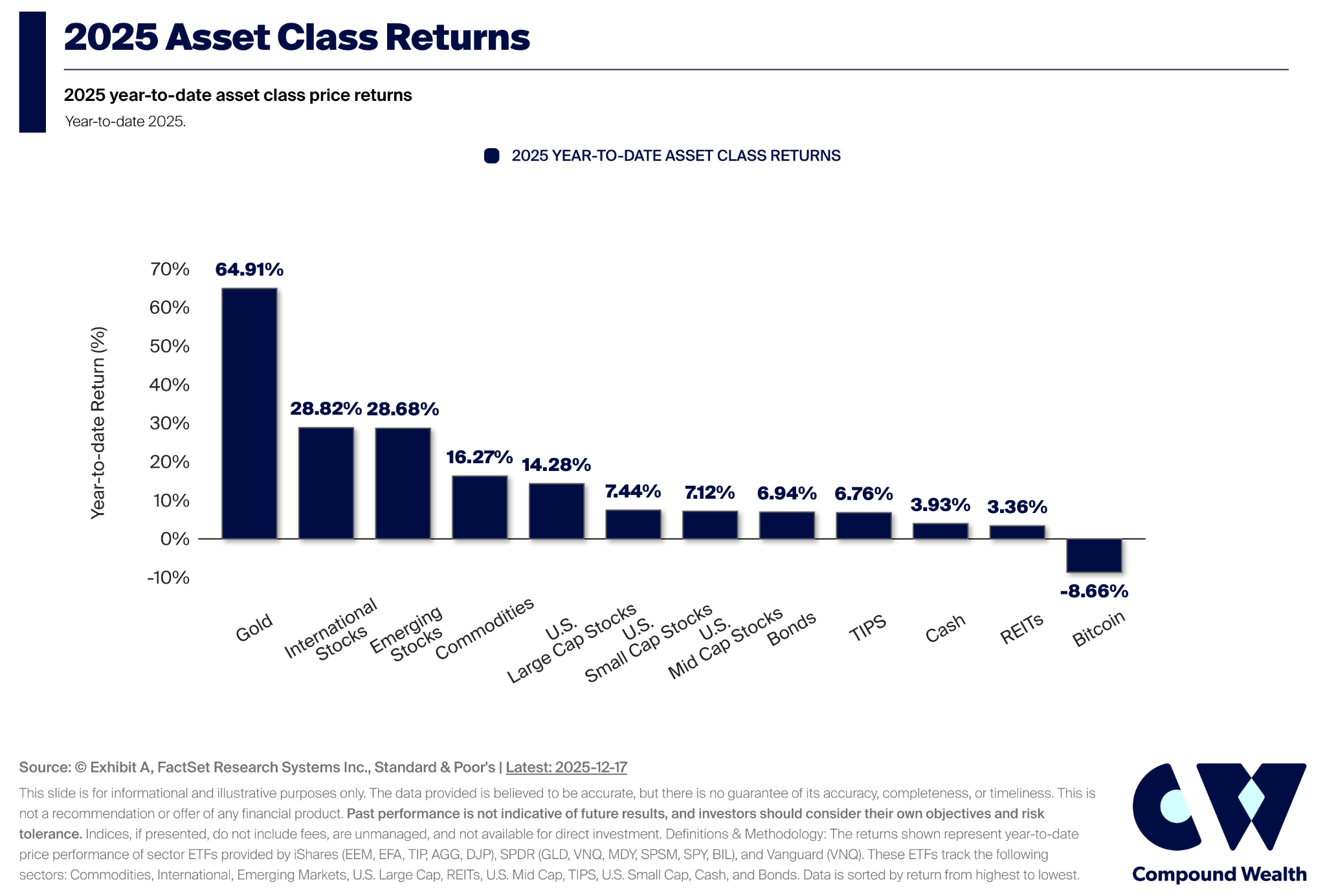

2025 Year-to-Date Market Returns: A Reminder of Why Diversification Matters

Below is a snapshot of year-to-date asset class returns for 2025 (to mid-December), which provides a useful lens on what has driven performance so far this year.

Why Staying Invested Still Wins: A Long Term Investor’s Guide to Market Noise

The best days in the market often occur very close to the worst days. Investors who try to time their exits are far more likely to miss those sharp recoveries.

What The New KiwiSaver Changes Mean For You

New KiwiSaver contribution rates are coming, and National wants to lift them even higher. This article explains what the changes mean, why tax settings matter more than most people realise, and how to build a plan that lets you retire on your terms.

Quarterly Market Update — September 2025

The September quarter was a strong one for investors, with global share markets continuing to march higher. Progress on US trade deals, renewed optimism around artificial intelligence (AI), and central banks shifting towards easier monetary policy all helped drive markets upward.

Despite ongoing political noise and slower economic growth in some regions, investors who stayed invested were well rewarded. For diversified portfolios, the combination of strong global equities and positive bond returns resulted in one of the best quarters in recent years.