Don’t let your KiwiSaver returns be Trumped

This article was originally shared here in March 2025 as part of the Market commentary and insights from Consilium and written by Ben Brinkerhoff, Head of Advice at Consilium.

Sometimes the noise is just too loud. At the moment, every headline seems to shout about yet another economic crisis. We know the media love a clickbait headline, often focusing on the negative, even when the bigger picture isn’t as bad as it seems.

Does all this noise have you worried about your KiwiSaver investments?

As Nobel laureate Robert Shiller put it, “The stories we tell ourselves shape how we see the world - and how we act.”

Right now, global events like Trump’s tariff threats have rattled markets, and the S&P 500 has fallen close to 10% at time of writing. It’s easy to see why KiwiSaver investors might consider switching to a more conservative fund, hoping to avoid potential losses. But here’s the thing - what seems like the safer choice could actually end up costing you more in the long run.

Markets have always had ups and downs - it’s how they work. And the best way to navigate these storms? Keep your cool and stick to your KiwiSaver plan.

Lessons from history - why switching can backfire

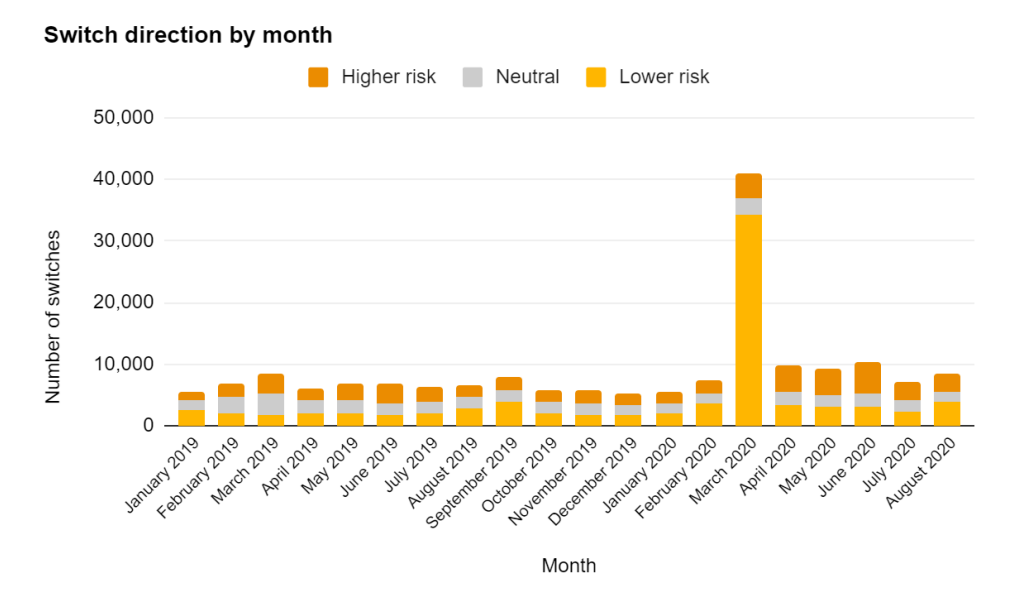

Think back to 2020. When COVID-19 first hit, the uncertainty was overwhelming, and the last thing many people felt like doing was staying invested in the market. A report by PwC titled “Lockdown: A Review of KiwiSaver Member Behaviour in Response to COVID-19”, showed that in March 2020, there was a spike in people switching their KiwiSaver to low risk funds. The problem? Many didn’t switch back when the markets recovered and they missed out on significant growth.

Those who tried to time the market ended up paying a heavy price. In 2020, KiwiSaver aggressive funds delivered an average return of 10%, while conservative funds returned just 5%. By 2021, the gap widened even further - aggressive funds soared with a 12% return, while conservative funds lagged behind at just 1%.

Let’s put this into perspective. If you had $10,000 in an aggressive fund in 2020, it would have grown to $11,000 by the end of the year. In contrast, the same amount in a conservative fund might have only reached $10,500. By 2021, the aggressive fund could have grown further to $12,320, while the conservative fund would have barely increased to $10,605.

The most surprising part? The people who switched the most were in the 26 to 35 age group - investors with the longest time horizons. These are the very people who could have benefited the most from staying invested, as they have decades to ride out market fluctuations.

The lesson here is simple - markets bounce back. But if you react out of fear and shift your savings to a safer option, you risk locking in losses and missing out on the recovery.

Why market dips can be good for your investments

Here’s something you may not realise - when the market drops, it creates opportunities for your KiwiSaver savings to grow even more.

If you’re regularly contributing to KiwiSaver, you’re buying units in your fund. When prices drop, your contributions buy more units than before, giving you more value for your money. Over time, those extra units grow as the market recovers, boosting your savings.

Think of it like shopping during a sale - you get more for your dollar. The same principle applies here. By staying invested during a downturn, you’re setting yourself up for bigger gains in the future.

When conservative funds make sense

Of course, staying in a higher-growth fund isn’t the right choice for everyone. If you’re nearing retirement or withdrawing your KiwiSaver savings, lower-risk funds like cash and bonds might be a better option. These funds are designed to provide stability and protect your savings from big market swings.

For example, bond funds have performed well recently, offering positive returns even during economic uncertainty. This can help retirees or near-retirees avoid selling investments when prices are down, preserving their savings.

If you’re not sure what fund is best for you, talk to a financial adviser. They can help you choose a fund that matches your goals and comfort level with risk.

What should you do next?

If you’re feeling uncertain about your KiwiSaver investments, here are some steps you can take:

1. Review your risk profile: Is your current fund aligned with your goals, timeframe and tolerance for risk? Younger investors or those with long term goals may benefit from growth or aggressive funds, while retirees may need a more conservative approach.

2. Talk to a financial adviser: Making changes to your KiwiSaver investments shouldn’t be done on a whim. A professional can help you navigate market conditions and ensure your investments match your personal circumstances.

3. Stay informed (but not overwhelmed): It’s natural to feel concerned during periods of volatility, but don’t let short term headlines dictate your investment decisions. Focus on the bigger picture and your long term goals.

Your KiwiSaver plan is for the long term

The road to retirement is a long one and there will always be bumps along the way. But if you stay patient and avoid making decisions based on fear, you’ll reap the rewards in the end.

Don’t let your KiwiSaver investments get trumped by short term thinking.

This article is provided for your information only. It does not constitute financial advice and has been prepared without taking into account any personal financial circumstances.

Need help maximising your KiwiSaver returns? Get in touch with us or complete our KiwiSaver Discovery Quiz.

Compound Wealth are a KiwiSaver, Retirement and Private Wealth Financial Advice Firm based in Mount Maunganui, Bay of Plenty with clients all over New Zealand.