The Value of Financial Advice

Why financial Advice Matters

Financial advice can help you navigate key financial decisions, ensuring better long-term outcomes, greater financial security, and peace of mind.

Better Retirement Preparation

Advised New Zealanders are twice as likely to feel prepared for retirement compared to those who do not seek advice. In fact, 80.8% of advised Kiwis have confidence they will enjoy a comfortable retirement, thanks to professional advice that ensures smart saving and investment decisions.

Maximise Your KiwiSaver

A financial adviser can help you get the most out of your KiwiSaver by ensuring your funds are optimized for growth, tailored to your risk profile, and aligned with your long-term goals. 82.3% of advised clients reported better KiwiSaver outcomes, highlighting the importance of expert guidance.

Smarter Investment Decisions

With the help of a financial adviser, you can make more informed decisions about where and how to invest. 88.1% of advised Kiwis believe they’ve achieved better investment outcomes, with returns that are more aligned with their personal financial goals. In contrast, unadvised individuals often miss key opportunities or take on unnecessary risks.

It’s not just about finances

Financial planning not only leads to better financial outcomes but also enhances overall well-being. When asked which aspects of life have improved from receiving financial advice (aside from finances) clients of financial planning advisers benefit from better quality family life and improved mental health. This illustrates the full scope of value that financial advice offers with a wide range of improvements in a client's life.

Personalised reports

Each of our clients receives customised reports outlining their financial health, performance of investments, and future projections. These reports give you the clarity you need to make informed decisions and adjust your strategy as needed.

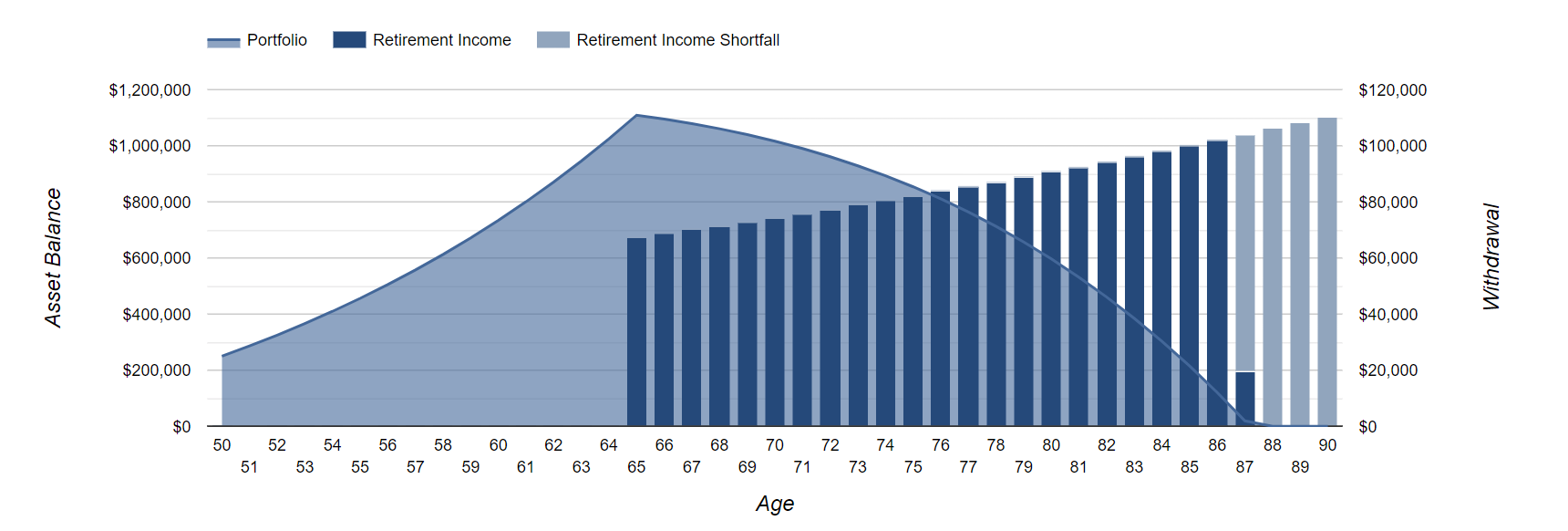

Cashflow Modelling

We have advanced cashflow modelling software that helps us to create a detailed cashflow model, so you can understand where your money goes and how to better manage your income and expenses to meet your future goals. This is especially important in retirement planning and managing investments.

Strategic Advice

At Compound Wealth, we provide you with tailored strategies designed to optimize your KiwiSaver, retirement savings, and investment plans. This ensures your decisions are aligned with your financial goals and life stage, creating a secure path to a better financial future.

on-going advice & reviews

Financial markets and personal circumstances change over time. We provide annual reviews to keep your financial strategy up-to-date, ensuring that you are always on track toward your retirement and investment goals.

Summary

The benefits of financial advice are clear: better outcomes, more confidence, and less stress. At Compound Wealth, we’re here to ensure that you get the most out of your KiwiSaver, investments and retirement planning. Take the next step in securing your financial future by working with an adviser who’s dedicated to helping you succeed.

Have questions? We're here to help! If you ever have questions about your reports or the advice we’ve provided, don’t hesitate to reach out. Our goal is to educate and empower you to feel confident about your finances. Whether you need clarification or simply want to discuss something further, we’re always happy to chat about finance!

Compound Wealth are a KiwiSaver, Retirement and Private Wealth Financial Advice Firm based in Mount Maunganui, Bay of Plenty with clients all over New Zealand.